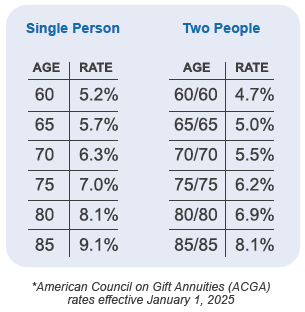

Rates vary depending on your age

Contact Us

For more information, including a no obligation gift illustration, please contact Dennis Kempf.

Dennis Kempf, MA

Director of Philanthropy

Phone: (314) 576-3993 ext. 222

dkempf@svdpusa.org

Charitable Gift Annuities

Want to be generous and also receive income because of your gift? A charitable gift annuity is a way to receive payments for the rest of your life while establishing a future gift for SVdP. And there are tax incentives to do just that.

BREAKING NEWS: These can now be established to benefit Councils as well!

Here Are the Three Key Ingredients

- Decide how you might want to fund this (minimum $20k):

a. Cash (you will receive a one-time charitable tax deduction for the year the gift is made)

b. Appreciated stocks (receive an income tax deduction, and reduce your capital gains tax)

c. A one-time IRA qualified charitable donation (“QCD”) gift of up to $55k IF you are at least 70 ½ years of age - One or two people can receive payments if they are 55+.

- After receiving payments for the rest of one’s life, the remaining funds will continue your legacy of supporting SVdP.

Additional options you may want to consider include deferring payments until later for higher payments.